33+ when you sign a mortgage you are

Web When you co-sign a mortgage with someone youre agreeing to take financial responsibility for the home loan in the event the primary borrower can no. Web Cosigning a mortgage involves taking on a lot of risk with little financial upside.

Craig Giles Mortgage Loan Originator Empire Home Loans Inc Nmls 1839243 Linkedin

When you co-sign a financial productwhether it be a mortgage a car loan or a credit cardyou could get burned.

. If you dont have the savings or established credit history to qualify for a cost-effective mortgage you may have a loan with high fees or interest rates. Ad Learn More About Mortgage Preapproval. Web The primary risk of co-signing a mortgage is it becomes your responsibility if the borrower doesnt make payments.

Web Because a co-signer guarantees that a mortgage will be paid off the co-signers credit score credit history and income can be used to bolster an otherwise weak applicants. Web When you get a mortgage loan you sign a contract and agree to pay back the lender. Browse Information at NerdWallet.

Web When you cosign on a mortgage loan youre putting your financial resources behind the loan. Veterans Use This Powerful VA Loan Benefit for Your Next Home. The servicer is the company that handles the daily management of your account.

A fee some lenders charge. Web FHA loans are government-backed loans that allow you to buy a home with a lower credit score and as little as 35 down. Take Advantage And Lock In A Great Rate.

Lenders may require that your co-signer be related to you by blood. Web It indicates you are a serious buyer and means that you are ready to move quickly on a property when you find one you love. Web Traditionally the industry advises that your monthly mortgage should not exceed 30 of your gross income.

Web A mortgage is a loan secured by property usually real estate property. Web Real talk. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

014 to 233 if putting less than 20 down. Web A Closing Disclosure outlines all the terms of your loan so you know exactly what youre getting when you sign your mortgage. Ad Here are 3 investments with higher yields that could essentially make your mortgage free.

This can help the borrower get much better interest rates and loan terms than they. Web If your mortgage rate is a quarter point higher youll pay 20 or so more per month on a 200000 thirty year loan. If you want to get an FHA loan with a co.

Lenders define it as the money borrowed to pay for real estate. Youre on the hook for the loan so co-signing. Use NerdWallet Reviews To Research Lenders.

Web Yes you can still get a mortgage if youve already co-signed for one though it will be more difficult. You wont receive a Loan Estimate or Closing Disclosure if you applied for a mortgage prior to October 3 2015 or if youre applying for a reverse mortgage. In essence the lender helps the buyer pay.

By law home buyers must receive a copy of the Closing Disclosure at least 3 business days before closing. If you are buying a 200000 home that requires a 90 loan-to-value loan you will need to have _____ as a minimum down payment. Web Mortgages that do including FHA loans have strict requirements about who can co-sign for you.

To qualify for a new mortgage youll need to prove that you can make the payments of the new mortgage and the payments of the co-signed loan. But as mortgage rates continue to decline many people may be tempted to go beyond 30. If youre considering cosigning your main motivation should be helping someone buy a home.

Buyers should take the time to thoroughly review these documents to understand the details of the loan. Ad Calculate Your Payment with 0 Down. Web Login Sign Up.

Web Co-signing a mortgage is a major act of trust for a person to make for you and if you jeopardize that persons credit by falling behind on that mortgage. A 1 interest rate difference costs you 50 per month more.

Open Esds

Home Spurr Mortgage

Mortgage Broker In Balmain Rozelle Five Dock Mortgage Choice

Foreclosure Prevention Moshes Law Firm 888 445 0234

5 Legal Tips To Consider Before Signing A Mortgage Ibiza Property Guide

Lee Godfrey Mortgage Broker In Oakleigh South Mortgage Choice

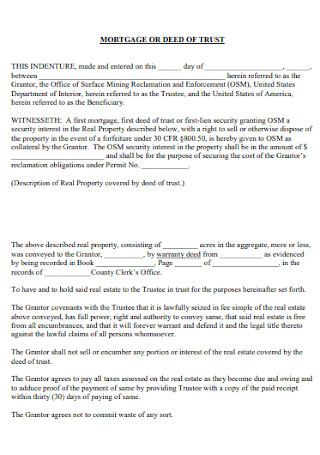

33 Sample Deed Of Trusts In Pdf Ms Word

Power Players 2022 Memphis Magazine

Town Country Bank Kearney Ravenna Pleasanton Litchfield Ne

Loan Chart Mortgage Mortgage Loans Home Loans

33 Best Free Css Javascript Timeline Idea Javascript Timeline Javascript Css

Pin On Naca Event Locations

4626 Humphrey Road Humphrey Ny 14741 Mls B1371702 Howard Hanna

Free 3 Real Estate Loan Proposal Samples In Pdf

Home Spurr Mortgage

Here S A Great Chart Showing If You Might Be Ready To Buy A Home Or Not If You Have Any Questions Please Feel Free To Give Home Buying How To

33 Posts That Show We Live In A Dystopian World